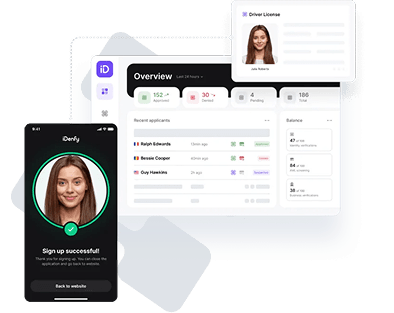

Secure & Compliant Identity Verification for Banking & Insurance.

Ensure compliance and trust with instant background checks and credential verification.

Industry Challenges

Ensuring global and regional compliance with regulatory mandates.

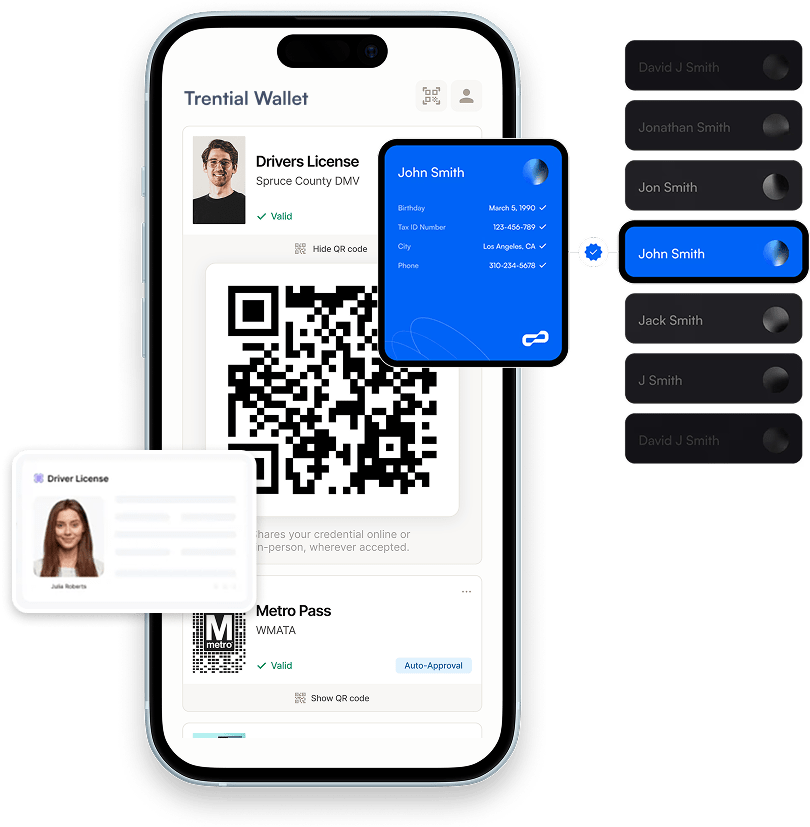

Fraudulent claims & fake identities

High risk of identity fraud in both banking and insurance.

Regulatory compliance

Strict KYC, AML, and financial regulations across sectors.

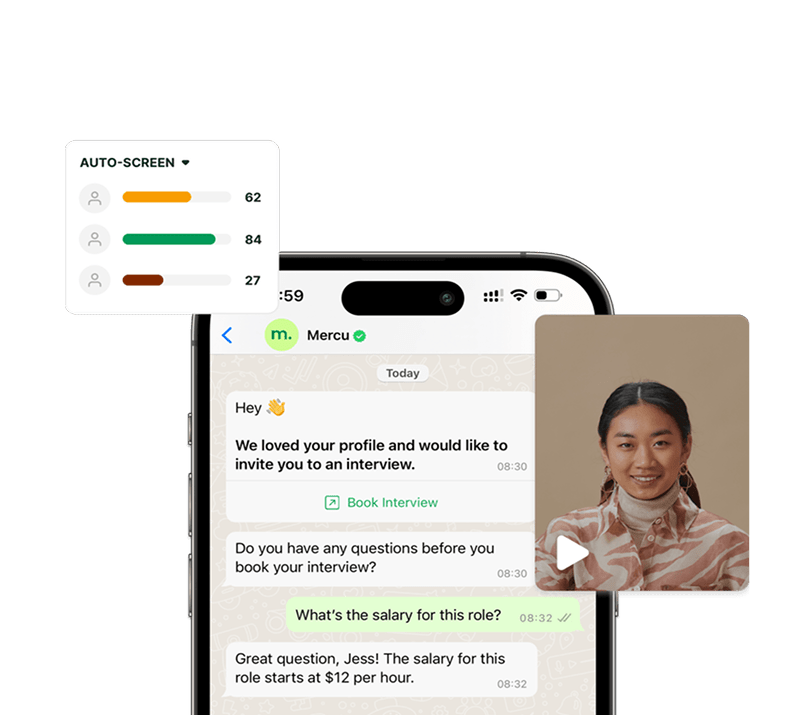

Slow Onboarding

Manual verification processes delay customer approvals.

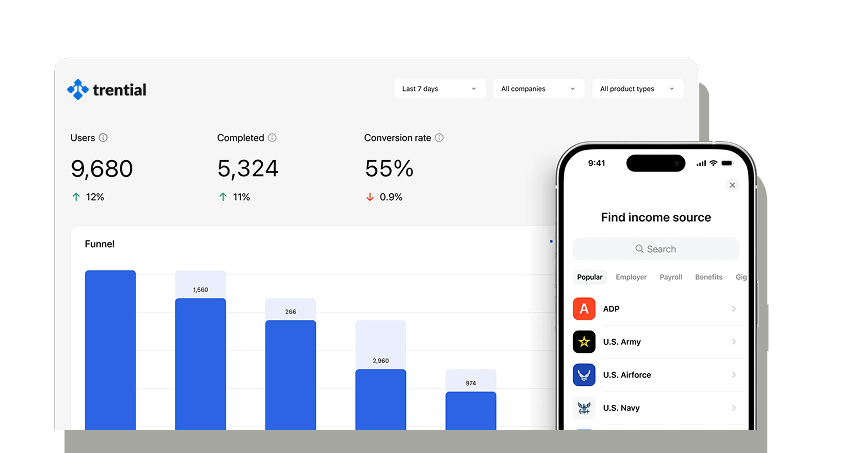

Trential’s Solution for Financial Services

Instant KYC & AML Checks

Real-time identity verification for customers and policyholders.

Learn More

Fraud Detection

AI-powered tools to prevent fake accounts & duplicate claims. Learn More

Seamless Integration

Secure APIs for banking, fintech, & insurance platforms. Learn More

Regulatory Compliance

Meets AML, GDPR, CCPA, and financial industry standards. Learn More

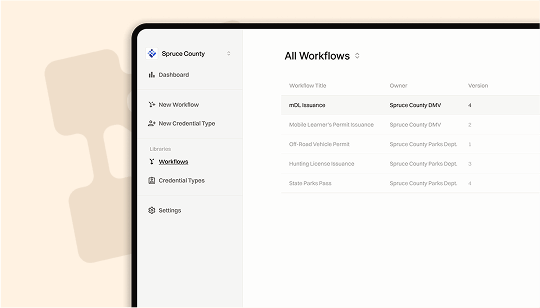

Use Cases

A seamless, secure, and efficient process designed for businesses and individuals alike.

Banking & Fintech

Secure onboarding for banks and wealth firms.

Auto & Health Insurance

Verify policyholders before issuance to prevent fraud.

Loan & Credit Providers

Reduce risk with pre-verified borrower profiles.

Compliance-First Background Verification

Ensuring global and regional compliance with regulatory mandates.

Meets AML, KYC, GDPR, and regional financial regulations

End-to-end encryption ensures secure data handling

Get Started with Secure Financial Verification

Talk to a Financial Verification Expert

Secure Your Workforce with AI-Driven Background Verification